How to calculate the employee provident fund contribution. 1 June 1991 PU.

Ilgl 06 A Employees Provident Fund And Miscellaneous Provisions Act 1952 Youtube

USA - Financial Sector - Cybersecurity.

. In 1982 then the EPF Act 1991 in 1991. Employees Provident Fund Rules 1991 - PU. A employees who are Malaysian citizens.

Unannotated Statutes of Malaysia - Principal ActsEMPLOYEES PROVIDENT FUND ACT 1991 Act 452EMPLOYEES PROVIDENT FUND ACT 1991 ACT 45239The chief executive officer may issue certificate to Inspector General of Police or the Director General of Immigration to prevent any person leaving Malaysia in certain circumstances. Employees Provident Fund Regulations 2001 - PU. Employees Provident Fund Act 1991 ACT 452 Regulations and Rules 1993 International Law Book Services Kuala Lumpur Malaysia p.

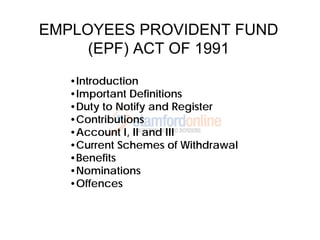

EPF is governed by the Employees Provident Fund Act 1991 EPF Act. Employee Provident Fund epf Kwsp - Epf Act 1991 act 452 - Third Schedule. 1 This Act may be cited as the Employees Provident Fund Act 1991.

1991 9 Employee Provident Fund Seventh Amendment Act 2048. B 2641991 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan. Unannotated Statutes of Malaysia - Principal ActsEMPLOYEES PROVIDENT FUND ACT 1991 Act 452EMPLOYEES PROVIDENT FUND ACT 1991 ACT 45226Power of the Board to invest.

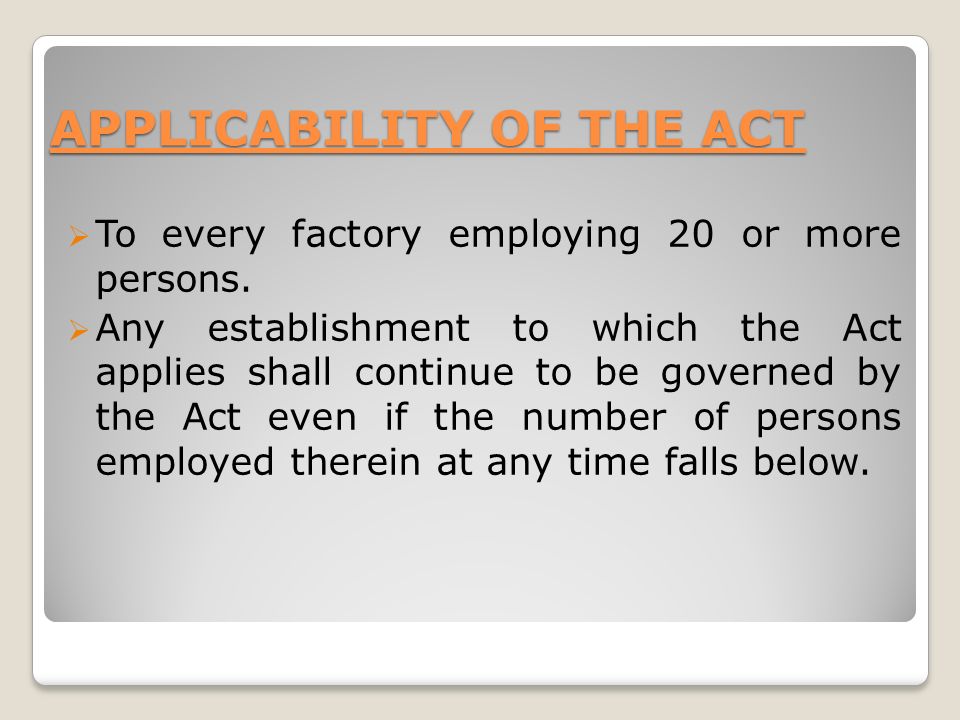

Short title extent and application41 This Act may be called the Employees Provident Funds and Miscellaneous Provisions Act. Employer means the person with whom an employee has entered into a contract of service or apprenticeship and includes-. The EPF Act 1991 requires employees and their employers to contribute towards their retirement savings.

The Third Schedule consists of five parts which specify the monthly contribution rate for each type. Act Number 10 of the Year 2019 1962 An Act made to provide for the Employee Provident Fund. Power of the Board to invest.

View Employee-Provident-Fund-Act-2019-1962pdf from BBA IT201 at Tribhuvan University. Act 452 EMPLOYEES PROVIDENT FUND ACT 1991 An Act to provide for the law relating to a scheme of savings for employees retirement and the management of the savings for the retirement purposes and for matters incidental thereto. The amendments to the Employees Provident Fund Act 1991 Principal Act that will come into operation on the above-referred date can be.

EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1. Whereas it is expedient to provide for Social Security Fund including Provident Fund Retirement Fund for the employees of the 2 Government of Nepal and corporate bodies 3 other employees and individual involving in self- employment Now. Section 2 of the EPF Act spells out the definition of an employer as follows.

EPF is governed by the Employees Provident Fund Act 1991 EPF Act. BE it enacted by Parliament as follows 1. In accordance with the Governments announcement on the reduced statutory contribution rate of employees share from 11 to 8 in accordance with the Third Schedule below are the amendments to Part A and Part B of the Third Schedule of EPF Act 1991 Amendment.

Legally the EPF is only obligated to provide 25 dividends as per Section 27 of the Employees Provident Fund Act 1991. The Minister has appointed 15 March 2020 as the date on which the provisions of the Employees Provident Fund Amendment Act 2019 Amendment Act will come into operation except for sections 6 8 and 11 thereof. 1-77 Malaysian Employment Legislation 2007-10-09 CCH Asia Pte Limited No.

Employer means the person with whom an employee has entered into a contract of service or apprenticeship and includes-a a manager agent or person responsible for the payment of. Employees Provident Fund Conduct And Discipline Rules 1993 - PU. Under this scheme every employee is required to make a contribution towards the provident fund at the rate of 12 of the Basic Wages Dearness Allowance and cash value of food concession.

Act 452 Employees Provident Fund Act 1991 incorporating all amendments up to 1 January 2006 View. For the purposes of this Act there shall be established a fund called the Employees Provident Fund hereafter in this Act referred to as the Fund. Employee Provident Fund Scheme 1952.

1 The Board may subject to subsection18 2 invest moneys belonging to the Fund in the following manner. Unannotated Statutes of Malaysia - Principal ActsEMPLOYEES PROVIDENT FUND ACT 1991 Act 452EMPLOYEES PROVIDENT FUND ACT 1991 ACT 45270bOmitted or Deleted Section. EMPLOYEES PROVIDENT FUND ACT 1991.

Employees Provident Fund Addition And Modification To The Purposes For Withdrawal Under Subsection 54 6 Order 2012. In this Act unless the context otherwise requires-- additional amount means the amount payable under section 58. Section 2 of the EPF Act spells out the definition of an employer as follows.

This Part shall apply to each member of the Fund who is not a Malaysian citizen who elects to contribute on or after 1 August 1998. 1 June 1991. The rate of monthly contributions specified in this Part shall apply to the following employees until the employees attain the age of sixty years.

2 This Act shall come into force on such date as the Minister may by notification in the Gazette appoint. Employers must calculate the EPF contribution amount based on the contribution rate in the Third Schedule of the EPF Act 1991 instead of the exact contribution rate percentage except for wages that exceed RM 20000. Sixth Amendment Act 2047 1991 20471027 10 Feb.

Further the employer also makes an equal amount of contribution as the employee towards the fund. Kumpulan Wang Simpanan Pekerja KWSP is a federal statutory body under the purview of the Ministry of Finance. An Act to provide for the institution of provident funds 23pension fund and deposit-linked insurance fund for employees in factories and other establishments.

1 Where an employee first becomes liable under section 10 to pay contributions to the Fund he shall then become a member of the Fund and continue to be a member of the Fund so long as. A a manager agent or person responsible for the payment. Employees Provident Fund EPF.

4 The EPF claims that the lowered dividend is the result of its decision to invest in low-risk fixed revenue instruments which produce lower returns but maintains the principal value of its members contributions. Wwwlawcommissiongovnp Employee Provident Fund Act 2019 1962 Date of Authentication and Publication in. An Act to provide for the law relating to a scheme of savings for employees retirement and the management of the savings for the retirement purposes and for matters incidental thereto.

Employee Provident Fund Act Otosection

Summary Of Case Study On Employee Provident Fund Of Malaysia

Epf Registration Online Process For Employer Social Security Benefits Registration Employment

The Employees Provident Funds And Miscellaneous Provisions Act Ppt Download

Epf Employees Provident Fund What Is It How It Works

Dhr 110 Week 12 13 Employees Provident Fund Act 1991

The Employee Provident Funds 1952 A Guide Ipleaders

Dhr 110 Week 12 13 Employees Provident Fund Act 1991

Summary Of Case Study On Employee Provident Fund Of Malaysia

Employees Provident Fund Epf Kwsp Malaysia Family My

Summary Of Case Study On Employee Provident Fund Of Malaysia

Chapter Three The Social Security Laws Ppt Download

Summary Of Case Study On Employee Provident Fund Of Malaysia

Ppt Employees Provident Fund Epf Malaysia Powerpoint Presentation Free To Download Id B3502 Nmjiy

![]()

I Citra Epf Says No Provision In Employees Provident Fund Act That Allows Withdrawals Under Natural Disasters Natural Disasters Disaster Response Disasters

I Citra Epf Says No Provision In Employees Provident Fund Act That Allows Withdrawals Under Natural Disasters Natural Disasters Disaster Response Disasters

The Employees Provident Funds And Miscellaneous Provisions Act Ppt Download

Employees Provident Fund And Miscellaneous Provisions Act Pdf Free Download